When a small business owner in the UK applies for a $250,000 business loan under their Government supported SME loan scheme the bank cannot ask for a personal guarantee. Under the Australian scheme the bank cannot request security. In New Zealand SME borrowers are asked for both security and personal guarantees. So why the differences? This article looks at the three SME loan support models to compare the features and specifically looks at personal guarantee requirements.

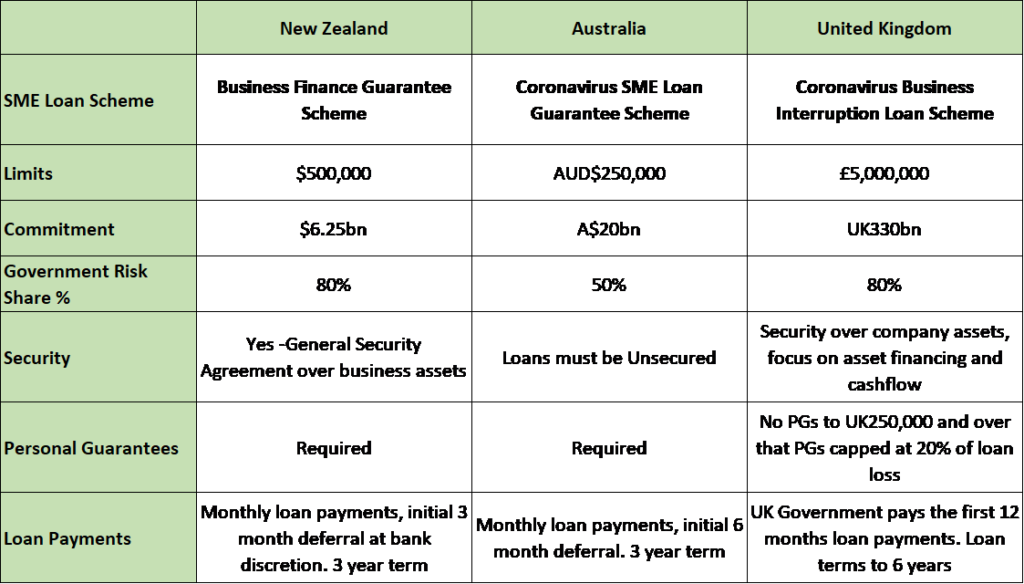

Here are the three SME Loan schemes

Some may wonder why the UK government do not ask for personal guarantees at all on small loans and only for a restricted guarantee on larger amounts. The reason is explained in my earlier article – Banks Must Lend Beyond Traditional Collateral, which explains the underlying heavy bank bias to property based lending. The UK regulators recognise that the only way to get banks away from relying on peoples’ homes as collateral is to specifically prohibit it. The Government is guaranteeing 80% of the risk so are instructing banks to assess the business on a stand-alone basis for their 20% risk share. The UK actively encourage asset based lending products under their scheme and non-bank lenders can also participate.

Even the Australian model, which is described as Unsecured, has a strong bias towards property because of the personal guarantee. In New Zealand the anecdotal evidence already is that the Austraian owned banks will only accept SME loan applications under the scheme from existing bank customers with personal guarantees backed by property. Will there be reporting of how many customers actually get access to finance without putting their home at risk?

The New Zealand SME loan guarantee scheme was developed by the Council of Financial Regulators, comprising the Reserve Bank, Financial Markets Authority, the Ministry of Business and Innovation and Treasury. That is representative of all the stakeholders except one, the customers who need the finance. Where is the input from the Small Business Advisory Council and others? SMEs are the driving force of economic growth and face challenges now that are greater than they have ever seen. New ways must be found to help them go forward. Many will still have sound business models and future orders to process but need liquidity desperately.

In my view the banks here and in Australia are not anti SMEs, they have simply failed to develop new ways of lending to them to keep pace with the needs. The simplistic property based focus will not be enough and their blanket catch-all personal guarantees discourage applications.

An Alternative Personal Guarantee Model for New Zealand

It will be very difficult to switch New Zealand into a no guarantee model and the likely impact would be even less lending. On the other hand SMEs are discouraged from taking risk and investing in their businesses if their home is at risk.

An alternative model is to have a limited personal guarantee whereby the SME owners are only liable for the debt if there has been fraud or theft of funds from the business. The SMEs must pledge that the finance will be used exclusively for business purposes and that personal drawings will be no higher than in previous periods or as per a business plan. They must disclose truthful information and cannot use the funds unreasonably, such as buying a new sports car, or get paid excessively, otherwise their conditional guarantee will be enforced.

The personal guarantee, if it is applied, should also be capped at 20% of the loss, as the UK model allows. The NZ Government already guarantees 80% of the risk under this scheme, while the bank takes 100% of the profit from the loans and has just 20% risk. Surely under that environment special conditions should apply.

Simon Thompson is an international specialist in Access to Finance for the SME sector. He is an ex banker and finance company CEO and has worked as a Consultant for the World Bank/IFC and Asian Development Bank in over 25 countries since 2006. He is a Director of Lock Finance, a niche NZ invoice financier, and has provided credit and risk management workshops for banks throughout Asia and the Pacific region.